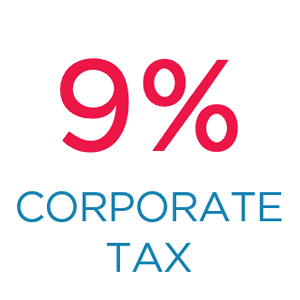

The state of Hungary has rejected an EU decree that would have required a 15% minimum tax rate on international firms, claiming that the tax would damage Europe’s competitiveness and jeopardise workers. So, now the corporate income tax rate in Hungary remains the same and amounts to 9%. Major firms would be responsible for paying the fee if their yearly turnover is above €750 million. The worldwide agreement that includes the tax change was reached by OECD (the Organization for Economic Co-operation and Development) last year. It has been approved by 136 nations that provide over 90% of the world’s GDP. It is expected that the change would annually bring approximately €140 billion to the state funds.

To take effect throughout the EU, the OECD deal must be incorporated into EU legislation according to official instructions. However, tax policy is one of the few fields where all countries must have a unanimous accord, so even disapproval of one of them can disable the whole deal.

The global minimum tax, according to Péter Szijjártó, the foreign minister of Hungary, is not needed since Europe is already in serious problems. He said that they’re not willing to put jobs in danger by supporting a hike in taxes for Hungarian companies.

In 2022, Hungary’s corporate income tax rate is 9%. With one of the lowest corporate tax rates among the 27 members of the European Union, Hungary has been able to draw significant investments in its manufacturing and auto industries, which have boosted economic development and employment.

Among countries that also didn’t agree with the European directive are Ireland and Estonia. Later, the three countries obtained assurances to allay their worries, including a protracted 10-year changeover phase. The conflict then moved to Poland, although the government there just made a concession when the European Commission approved its long-stalled recovery plan. Hungary’s recovery strategy is still being hampered due to issues with nepotism, fraud, and corruption. As a result, Hungarian resistance to the OECD tax became a fatal problem in the efforts of European Ministers to set the 15% levy.

Hungary’s corporate tax rate

The corporate income tax rate in Hungary is the central assessment that is levied from business profits. Its amount is determined by the net profits businesses make from running their operations, frequently over the course of one fiscal year. The corporate tax rate is a significant source of revenue for the Hungarian government.

Taxing is working If a company is incorporated in Hungary or has its management headquarters there after being formed abroad.

Moreover, nonnatives have a tax on earnings from a Hungarian source; natives are taxed on all profit. Although branches and subsidiaries are taxed in the same ways, there may be some additional modifications if the head office is located in a non-treaty nation.

Hungary is a good place to invest in terms of taxes as well because of its low corporate income tax base, the extensive array of tax incentives and useful assets (particularly those for advancement and investment), and the steadily falling employment tax burden. This is objectively true even if it seems to be oftentimes overwhelming red tape and the perceived complexity of the tax system.

Please contact us to get more information.

Also, you can view new offers in the categories “Cryptocoins and licensing of cryptocurrency operations”, “Ready-made companies”, “Banks for sale” and “Licenses for sale”.